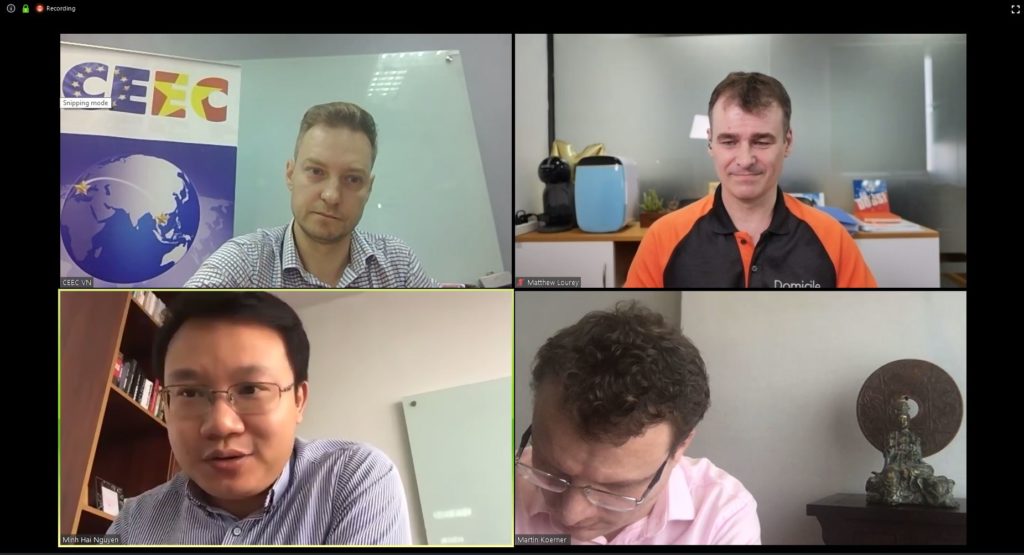

Today, on 16th April CEEC hosted the Share&(L)Earn webinar on Managing Risk and Compliance under COVID-19 in Vietnam. What can businesses do?

After a welcoming speech from CEEC Chairman, Marko Moric, who briefly introduced CEEC and Share&Learn events, Mr. Matthew Lourey, Managing Partner at Domicile Corporate Services, gave a very practical presentation focused on impact and risks for businesses, labour and employment implications, work permit, TRCs and visas, corporate governance & compliance and deferring taxes and land rental.

Mr. Lourey pointed that situation we are facing now, will have a long-term impact. The companies should take an advantage of the situation and react quickly to be ready to restart when the virus will be overcome. He recommended to be proactive with protecting your business, negotiate early with landlords, suppliers and staff, plan and protect, in order to survive, focus on conserving cash and take care of your staff.

He mentioned Article 38 of the Labour Code 2012 allows an employer to terminate the contract with employee as a consequence of natural disasters, fire or other force majeure events. However this is a process and employer must take all measures to overcome the consequences. Salary reduction can also happen, however any reduction in salary needs to be agreed by employer and employee by mutual consent.

The issuance of new visas for Vietnam has been suspended, but people with existing visas which are expiring are most likely to get an extensions. Work Permit extensions are currently being processed, provided that the individual has not left Vietnam since 1 February 2020. There are some cases of temporary extensions (via a replacement visa) recently for those individuals whose TRC’s have expired but the authorities will most probably begin to issue TRC’s for valid cases again shortly. The law on TRC’s will change in 1 July 2020 and will require a contributing capital in excess of 3 billion from investors to be entitle to receive a TRC.

At the next part, Matthew was talking about deferring taxes and land rental. Key points covered were deferral of CIT, deferral of VAT, VAT and PIT deferrals for individuals and land rental deferrals.

Following Matthew’s presentation, we could hear a panel discussion with the insights from government policies shared by Minh Nguyen from Mazars Vietnam and from hospitality shared by Martin Koerner from The Anam.

The presentation was concluded with some questions from the moderator and the audience. The full presentation can be found here.

CEEC would like to thank you to the speakers for useful information shared and attendees for participation.