On 5 December 2016, CEEC 4th Share & Learn happened with the topic relating to personal income tax. At the beginning, Mr. Christoph Schill, CEEC Vice-Chairman warmly welcomed the Share&(L)Earn guest speaker and all participants and thanked Dr. Pana and Ms. Tam for their attendance.

Mr. Csaba Szoke, CEEC Executive Committee member, introduced H.E. Dr. Petra Pana, Deputy State Secretary of the Hungarian Ministry of Foreign Affairs and Trade and the delegation from the Hungarian Consulate General of Ho Chi Minh City, as well as Ms. Do Thanh Tam, Director of Tax and Advisory Services of Mazars Vietnam.

Following the introductions, our honorary guest, Dr. Petra Pana, welcomed participants of Share&(L)Earn event and pointed out in her speech that CEE companies doing business in Vietnam have a key role in building a culture of the cooperation with Vietnam.

Dr. Pana also reflected on past and present relations between Hungary and Vietnam. “Today our relationship is built on commercial and cultural grounds, rather than political ones”, she emphasized. CEEC has a significant role in building these relations and H.E. highly appreciated our contribution.

Dr Pana praised the newly opened Hungarian Consulate in HCMC and ensured that it will make all efforts possible to enhance commercial and cultural relationships with Vietnam and will provide all possible support in HCMC.

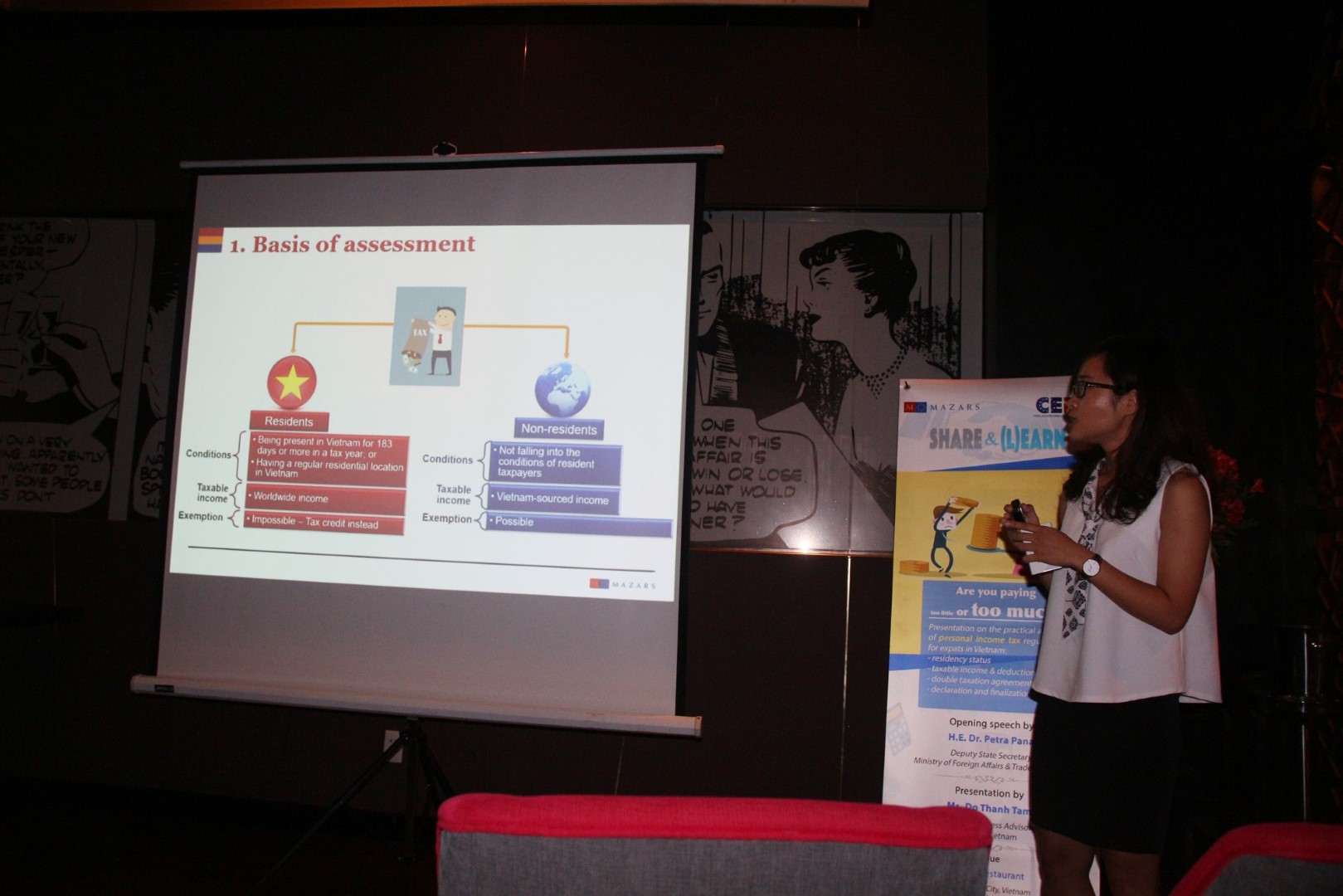

Afterwards Ms. Do Thanh Tam gave a very interesting and comprehensive presentation about personal income tax for expatriates in Vietnam. Key points covered were tax residency issues, tax assessment periods, tax exemptions and taxable elements of various types of incomes, double taxation agreements and a short survival guide for expats. The presentation (which can be found here) was concluded with many questions from the audience and in answering which Ms. Tam gave several practical examples as well.

Please don’t forget to visit our sites to update information on our interesting and helpful upcoming events.